Never before have so many assets been passed on to the next generation, which is why people are also talking about “Generation H” (H stands for heirs). One of them is Valerie Rockefeller, the great-great-granddaughter of the world’s first billionaire, John D. Rockefeller. The modern-day philanthropist presides over the Rockefeller Brothers Fund, a 1.3 billion dollar foundation that has attracted attention for breaking away from what established the dynasty 150 years ago: oil.

Valerie Rockefeller…

1. …about her childhood as a famous heiress

I grew up in the southern part of West Virginia, in a poor coal-mining region. Being a Rockefeller wasn’t particularly popular there. My siblings and I went to the public school, where we sometimes got teased so we were afraid of seeming like spoiled rich kids. It wasn’t until my twenties that I realised that my name also entailed positive associations. I began my teaching career in East Harlem, where an African-American co-worker told me that her education had been funded by a Rockefeller grant. That’s when I learned about the Rockefeller Brothers Fund.

2. …about the possibility of leading a self-determined life

As my father was a local West Virginian politician and then a Democratic senator, our family was always in the public eye, and we children had to be on our best behaviour. Of course it’s an enormous privilege to be born with a lot of money, but it also brings with it a great moral obligation to show gratitude and give something back to society. “To whom much is given, much will be required,” is like our family credo; the saying comes from the Bible and was a favourite of my great-grandfather John D. Rockefeller Jr.. Nevertheless, I have never felt controlled by my relatives, no one has ever told me how to give something back. I was always encouraged by my family to do my own thing.

3. …on the question of how to do good

The Rockefeller Brothers Fund was founded in 1940 by the third generation of our family. The foundation’s assets amount to 1.3 billion US dollars, and over 5 percent of this is given as grants every year. Like so many Rockefeller heirs, we support a modern approach to philanthropy. Instead of just writing a cheque, we aim to achieve as much impact as possible and results that are actually measurable. We are also able to react very quickly to emergencies – such as the current coronavirus crisis – and we are careful to invest our capital in alignment with the goals of our programs in sustainable development, peacebuilding, and democratic practice. It’s counterproductive to invest in fossil fuels, on the one hand, and, on the other, to use donations to support an NGO in its fight against the construction of coal-fired power plants in Kosovo.

4. …on the phasing out of fossil fuels

The Rockefeller fortune is rooted in the oil business, and that is exactly why it was a moral obligation as well as a financially responsible move for us to divest from fossil fuels. In 2010, the board of the Rockefeller Brothers Fund, which is comprised of half family and half outside expert trustees, decided to invest sustainably. In 2014 we announced we would join the global Divest-Invest movement, which now represents 17 trillion US dollars in assets under management. Now we invest in companies that stand for an ecological and sustainable future so the Fund’s investment portfolio is 99 percent free of fossil fuels. In this way, we have been able to contribute to the debate on investor responsibility.

5. …on the economic potential of sustainable investments

By opting out of non-renewable energies, we wanted to show that sustainability is also economically worthwhile. We are convinced that fossil fuels have no future as an energy source and indeed over the last decade these companies are increasingly losing value. Instead, we have invested primarily in clean energy and sustainable housing for example. Over the past six years, we achieved an average annual performance of 7.8% versus our 6.7% benchmark. I hope this will encourage other institutional and individual investors to make the same transition.

6. …on the promotion of self-determination through philanthropy

Our donations focus on helping people to help themselves. Our goal is to promote people’s self-determination. That is why we support local organisations, for instance in the Middle East, Afghanistan or Iran, which work for democracy, women’s rights and human rights as necessary conditions for a just peace. We are convinced that if people are allowed to determine their own destiny and if they are given the opportunity to do so, they will solve their problems themselves.

7. …on social inequality

I have to admit, I feel guilty about the enormous wealth disparity in the United States particularly but also around the world. I believe those of us privileged with wealth have a duty to combat social inequality. We must do everything we can in our organisations and in selecting our partners to foster justice. The Rockefeller Brothers Fund undertook a deep “diversity, equity and inclusion” process several years ago, and we have a powerful statement on our website. We also prefer to invest in funds and donate to organisations run by women and under-represented minorities.

8. …about the importance of earning your own money as an heir

I’ll be honest with you: I worked as a teacher for a long time but I never fully maintained my standard of living on the money I earned. Today I devote my time almost exclusively to charity commitments, and I earn practically nothing. Maybe it is wrong to live off of the money my grandparents gave me. I definitely think it’s important to have a good education and gain experience in the world of work both paid and voluntary.

9. …about the right time to discuss the topic of inheritance with your children

In the Rockefeller family, the money is protected in trusts, and traditionally the heirs do not have access to it at a young age. But I think it’s wrong to make the subject a taboo, as often happens, and as my parents did. Money means influence and choices, and that’s why we talk about it with our three adolescent children. It’s important to us that they are aware of the impact of their financial decisions and think about how to spend their money responsibly.

10. …on her most important advice to communities of heirs

Be transparent! Discuss your goals openly and honestly with your children. And have high expectations of family members; set the same standards for them as for everyone else. With us, everyone has to work for the right to serve on the boards of family nonprofits – I think that’s right. You have to be worthy of the professional staff. The money belongs to future generations and serves to make the world a better place.

Cover image: Luxwerk

Valerie Rockefeller

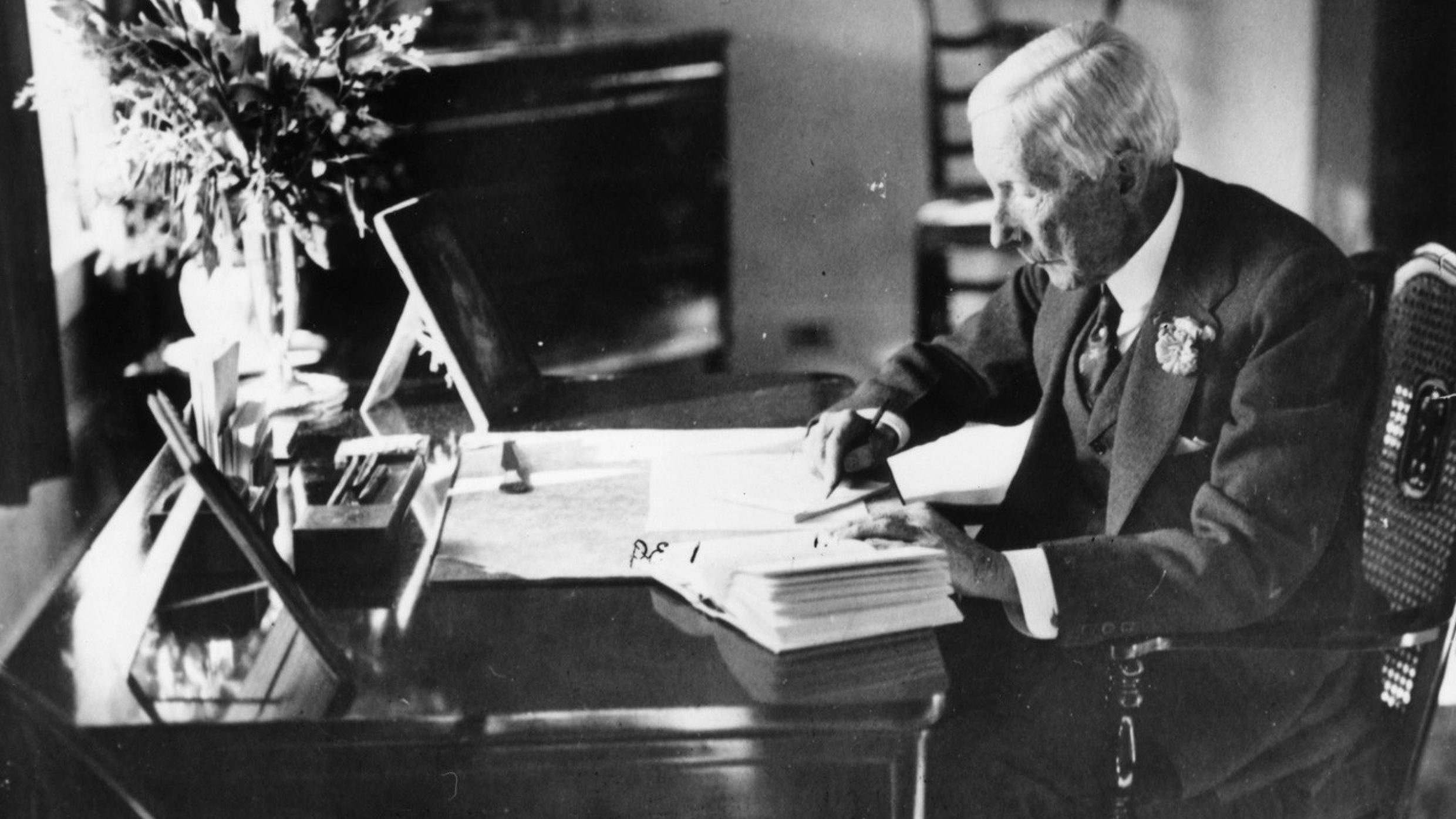

Valerie Rockefeller (50) is the great-great-granddaughter of the legendary oil tycoon John D. Rockefeller and Chair of the Board of Trustees of the Rockefeller Brothers Fund. The foundation’s assets amount to 1.3 billion US dollars, and the foundation has been committed to sustainable investing and the phase-out of non-renewable energy since 2010. Valerie Rockefeller’s family is one of the most famous American entrepreneurial dynasties: John D. Rockefeller founded Standard Oil, the world’s largest oil refining company at the time, and is still considered to be the richest American of all time. His descendants built Rockefeller Center in New York, founded the University of Chicago, donated national parks to the U.S. government, donated land for the United Nations and initiated the Museum of Modern Art. Valerie Rockefeller has long worked as a teacher for young people with learning disabilities and lives with her three children in Old Greenwich, Connecticut, USA.