Despite challenging economic times, today more Swiss are looking to the future with unconditional optimism than in the past two years. Financial confidence has also increased slightly. Self-determination, meanwhile, remains stable, as shown by the results of Swiss Life’s latest self-determination barometer.

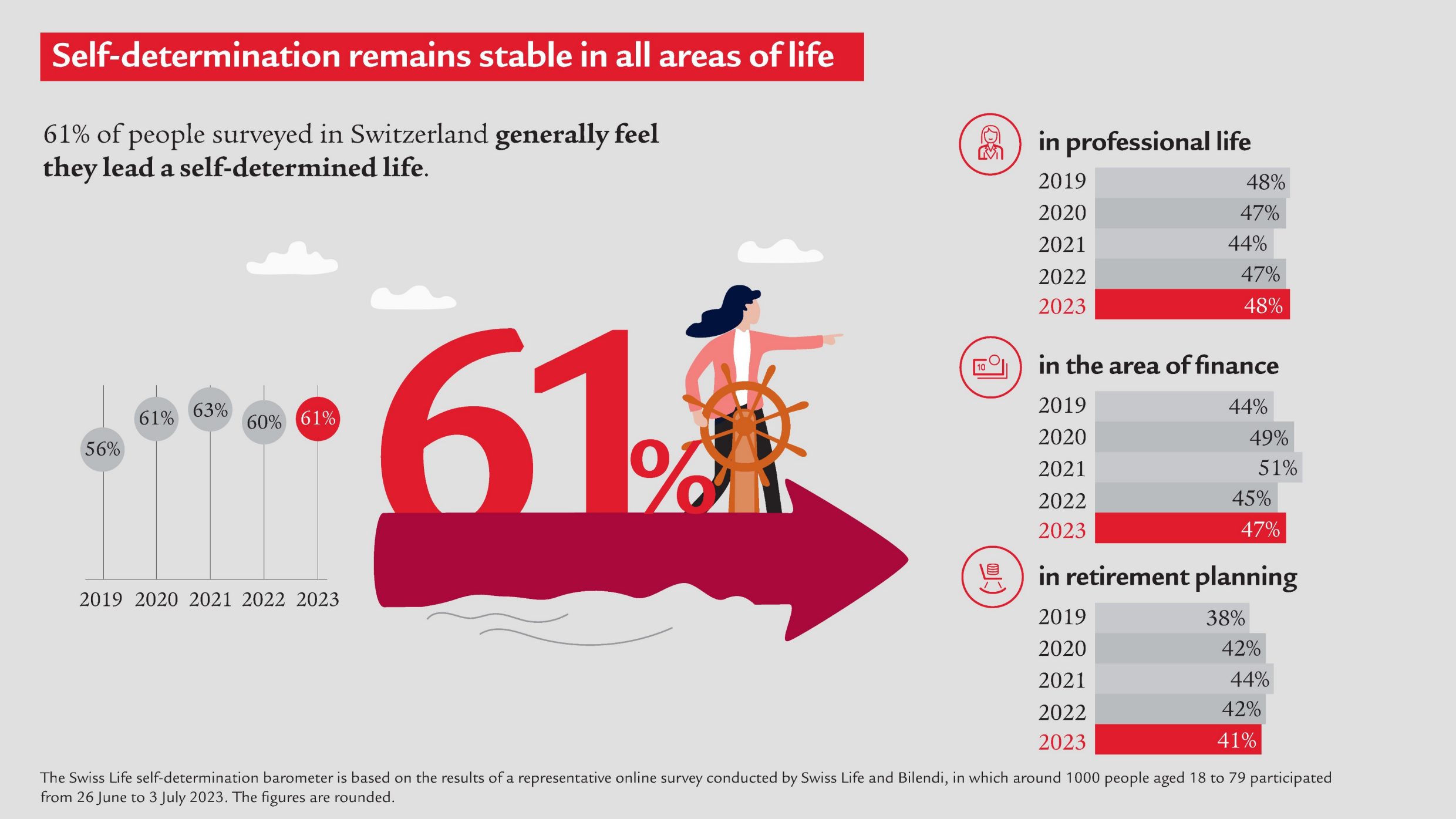

In a representative survey conducted by Swiss Life, 61% of Swiss said they lead a self-determined life (2022: 60%). Self-determination in Switzerland therefore remains stable, both overall and in terms of professional life, retirement provisions and finances. Only 14% said their self-determination has fallen in the past twelve months. The main reason for this is the financial burden resulting from inflation and the rising cost of living.

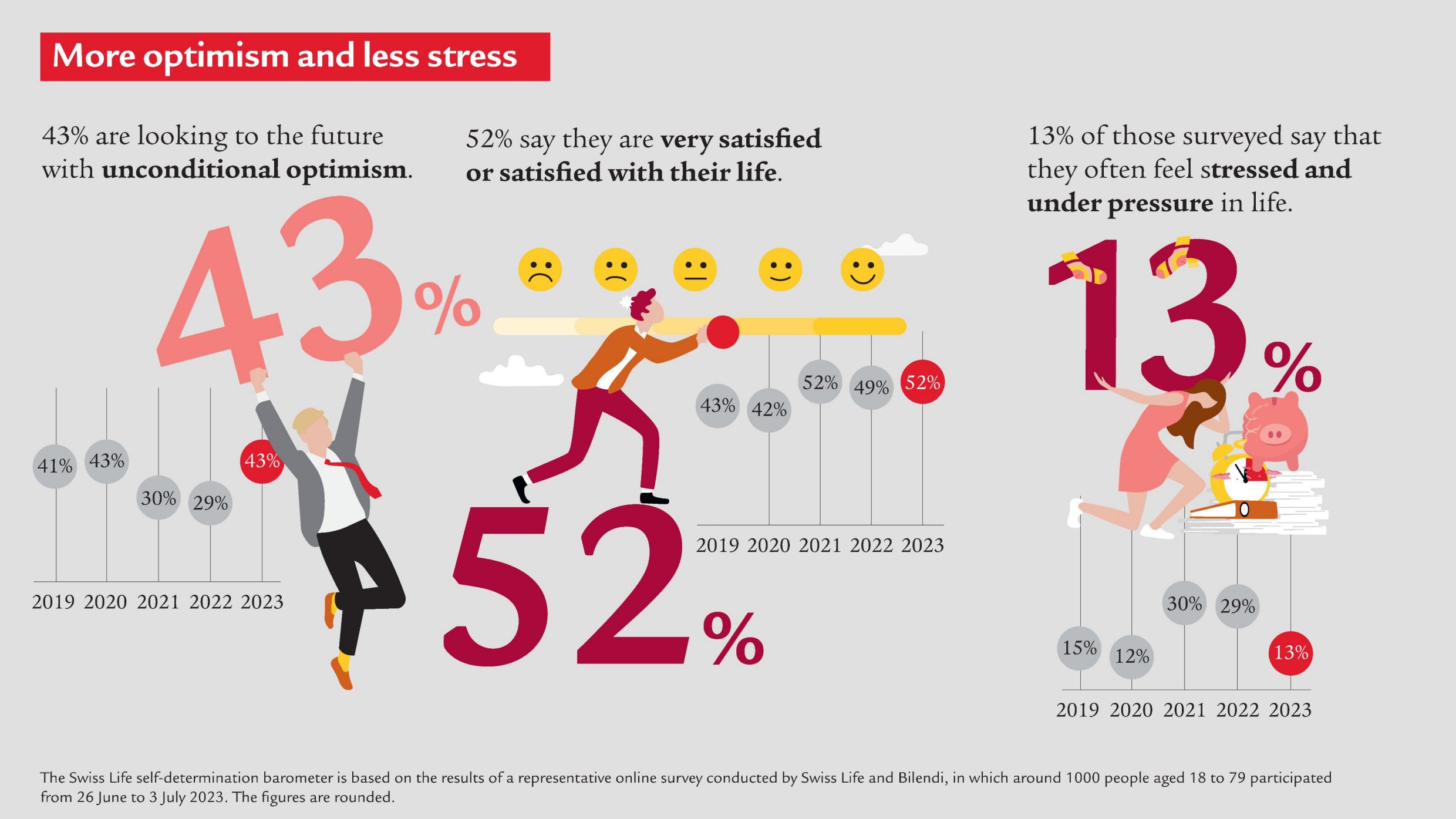

More optimism and less stress

After two years shaped by the coronavirus pandemic as well as various financial and political crises, the Swiss are once again confident in 2023: 43% are looking to the future with unconditional optimism. In previous years, this value was less than a third (29% in 2022 and 30% in 2021). This means that optimism amongst people in Switzerland has returned to its 2019 level (41%).

Overall, satisfaction amongst the Swiss surveyed is high, with 52% saying they are very satisfied or satisfied with their life (2022: 49%). At the same time, their stress levels have fallen significantly: only 13% of those surveyed said they often feel stressed and under pressure in life – regardless of gender, age or place of residence. In the previous year, the figure was significantly higher at 29%.

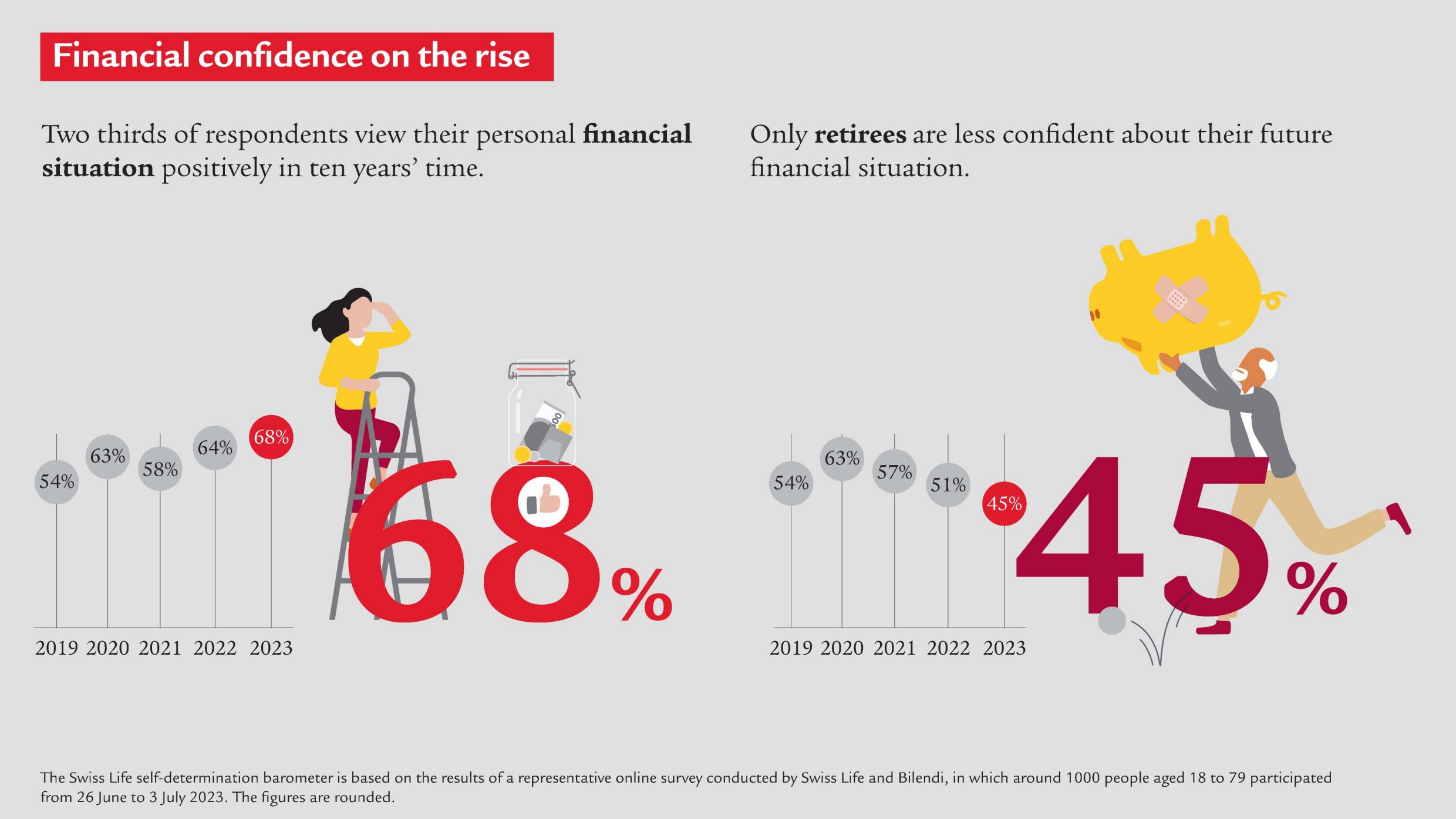

Financial confidence on the rise

The financial confidence of people in Switzerland increased further in 2023, with just over two thirds of those surveyed viewing their personal financial situation positively in ten years’ time. This is 4 percentage points more than in 2022. Only retirees are less confident about their future financial situation, with only 45% of respondents saying they are positive about their financial situation in ten years’ time (2022: 51%).

However, around a third of respondents in Switzerland do not believe it is worth investing money over the long term (2022: 24%). One in four people surveyed also claimed to live from day to day in terms of their finances.

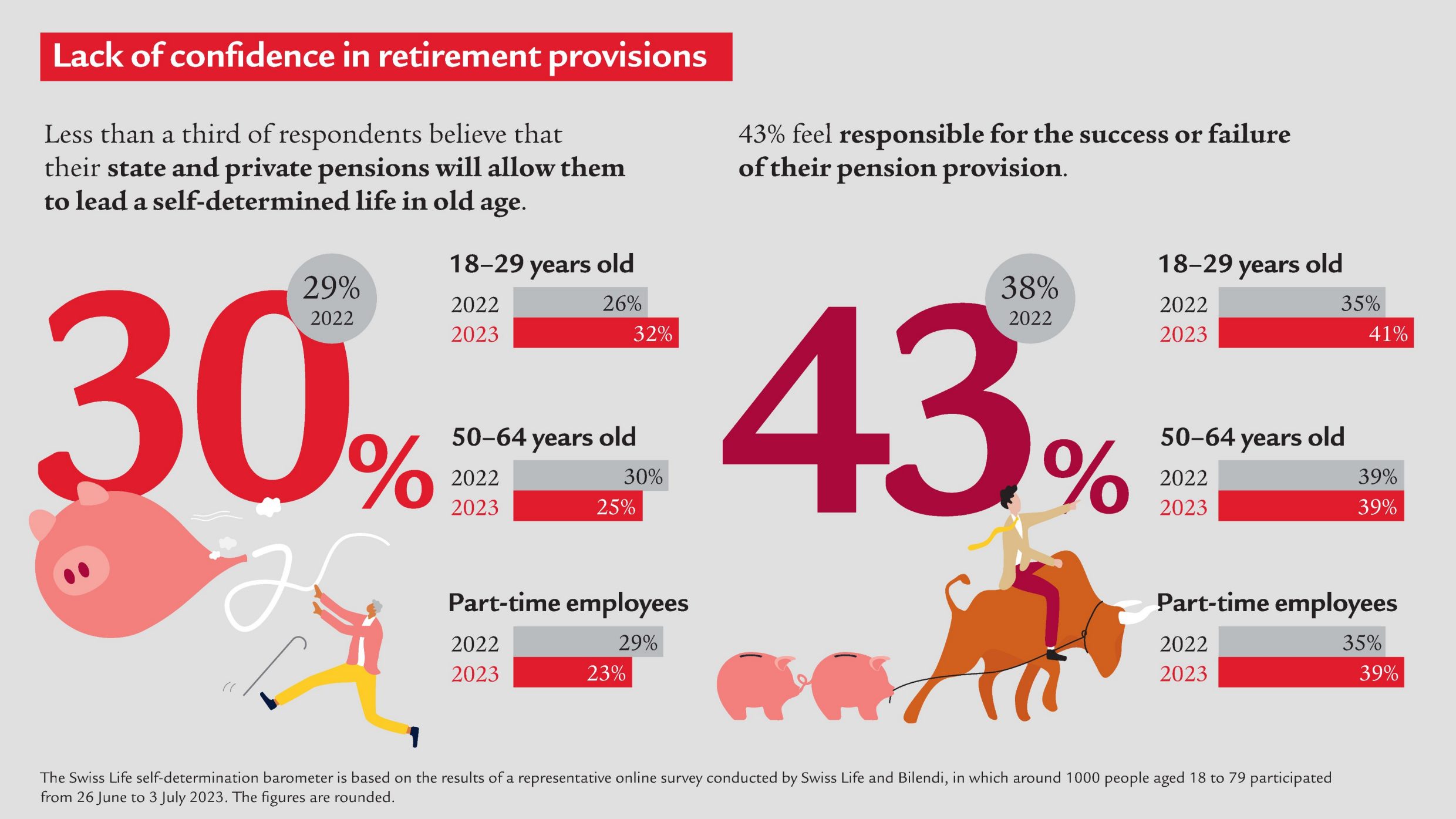

Lack of confidence in retirement provisions

Confidence in retirement provisions remains low: less than a third of people surveyed in Switzerland believed that their state and private pensions will enable them to lead a self-determined life in old age (2023: 30%; 2022: 29%).

Confidence has increased amongst the younger age group: 32% of 18–29-year-olds are convinced that their state and private pensions will allow them to lead a self-determined life in old age. This is six percentage points up from the previous year. At 41%, a growing proportion of people in this age group also feel responsible for the success or failure of their pension provision (2022: 35%). By contrast, respondents in the 50–64 age group (25% vs. 20% in 2022) and those in part-time employment (23% vs. 17% in 2022) have less confidence in their pension provision.

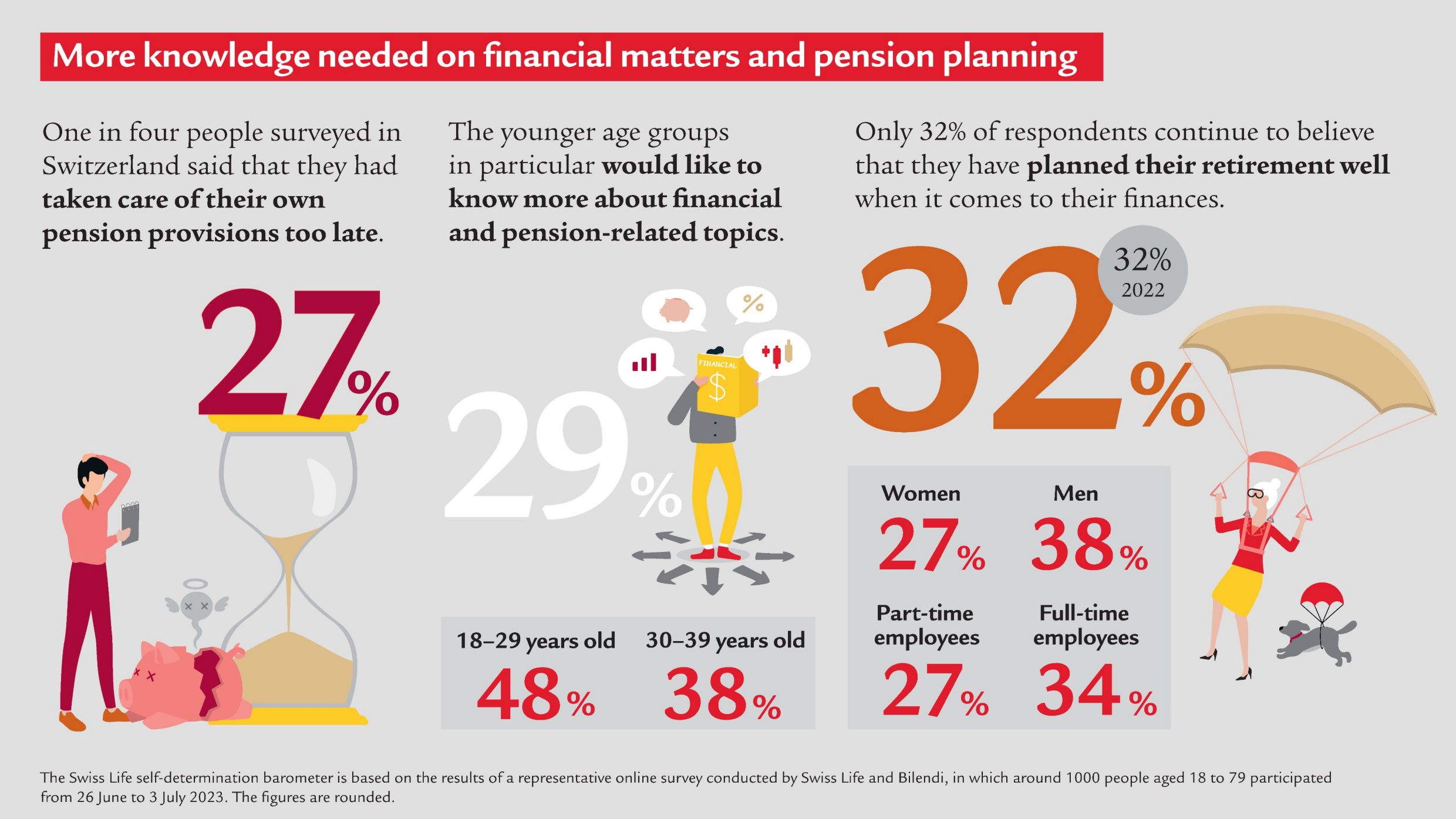

More knowledge needed on financial matters and pension planning

One in four people surveyed in Switzerland said that they had taken care of their own pension provisions too late and would like to know more about financial and pension-related topics. The greatest need for more financial literacy is amongst the younger age groups of 18–29 year olds (48%) and 30–39 year olds (38%). As such, only 32% of respondents continue to believe that they have planned their retirement well when it comes to their finances. Women (27% vs. men 38%) and part-time employees (27% vs. full-time employees 34%) in particular lag far behind in this regard.

Respondents were more than willing to look after their own finances, with more than one in three saying they would happily save even more so they have a solid pension. Younger people are much more motivated to do so than older people (18–29: 46%; 30–39: 42%; 40–49: 38%; 50–64: 33%; 65+: 27%).

The opinions of the people surveyed in Switzerland as part of the self-determination barometer differ on this point: a good 30% say they regret not having taken greater advantage of the options open to them in their younger years. This compares to around 30% who have no regrets, with the remaining almost 40% somewhere in the middle.

Swiss Life self-determination barometer

Swiss Life enables people to lead a self-determined life. In this context the company launched the Swiss Life self-determination barometer in 2019. This addresses the question of how self-determined people feel, what factors are involved and how they expect their degree of self-determination to develop in the future. Swiss Life and market research company Bilendi surveyed about 1000 people between the ages of 18 and 79 in Switzerland online from 26 June to 3 July 2023 for the 2023 self-determination barometer. Besides Switzerland, representative surveys for the Swiss Life self-determination barometer are also conducted in France, Germany and Austria.

Further contributions and studies by Swiss Life on the self-determined life

Swiss Life enables people to lead a self-determined life and regularly publishes interviews with experts, inspiring articles, and representative surveys on the subject. You can find all the contributions and studies on our blog.